ACCESS LEVERAGE GOVERNANCE DIVERSIFICATION TAX SHELTER EXPERTISE

ACOF1 seeks to deliver compelling risk-adjusted returns, with a focus on capital appreciation.

ACOF1 seeks to achieve this objective through investments in a diversified portfolio of directly originated senior secured loans to U.S. middle market and upper middle market companies.

Our strategy employs portfolio diversification and prudent use of leverage to enhance returns while maintaining a strong emphasis on downside protection.

Managed by Adnate Capital Management LLC, ACOF1 is grounded in disciplined underwriting, robust governance, and rigorous risk management, with a long-term focus on capital preservation and value creation.

ACOF1 seeks to deliver compelling risk-adjusted returns, with a focus on capital appreciation.

By investing in a diversified portfolio of directly originated senior secured loans to U.S. middle market and upper middle market companies.

Our strategy employs portfolio diversification and prudent use of leverage to enhance returns while maintaining a strong emphasis on downside protection.

Managed by Adnate Capital Management LLC, ACOF1 is grounded in disciplined underwriting, robust governance, and rigorous risk management, with a long-term focus on capital preservation and value creation.

ACOF1 seeks to deliver compelling risk-adjusted returns, with a focus on capital appreciation, by investing in a diversified portfolio of directly originated senior secured loans to U.S. middle market and upper middle market companies. The strategy employs portfolio diversification and prudent use of leverage to enhance returns while maintaining a strong emphasis on downside protection.

Managed by Adnate Capital Management LLC, ACOF1 is grounded in disciplined underwriting, robust governance, and rigorous risk management, with a long-term focus on capital preservation and value creation.

Why ACOF1?

Access

Leverage

Governance

Diversification

Tax Shelter

Expertise

Access

Leverage

Governance

Diversification

Tax Shelter

Expertise

Strategy

Our investment strategy is designed to deliver attractive risk-adjusted returns through strategic investments, diversification, and active portfolio management, guided by the expertise of the Investment Manager.

Portfolio Allocation:

Senior secured first lien loans to U.S. middle market companies, sourced through direct origination,

intermediaries, or the syndicated loan market, with an emphasis on privately negotiated transactions.

Opportunistic Investments

Selective exposure to second lien loans, subordinated debt, mezzanine financing, and equity or warrants, focusing on sponsor-backed companies and rigorous risk management.

Flexible and Dynamic Approach

Maintain sector, geographic, and deal size diversification while preserving flexibility to pursue emerging private credit opportunities and adapt to changing market conditions.

Why Private Credit?

Private credit has grown from $100 billion in 2000 to over $2 trillion by 2024, driven by the retreat of traditional banks and rising institutional demand. It offers higher yields, lower volatility, senior secured positioning, and protection against rising rates. With strong market tailwinds, private credit is projected to surpass $3 trillion by 2028, attracting more institutional investments for diversification and stable income.

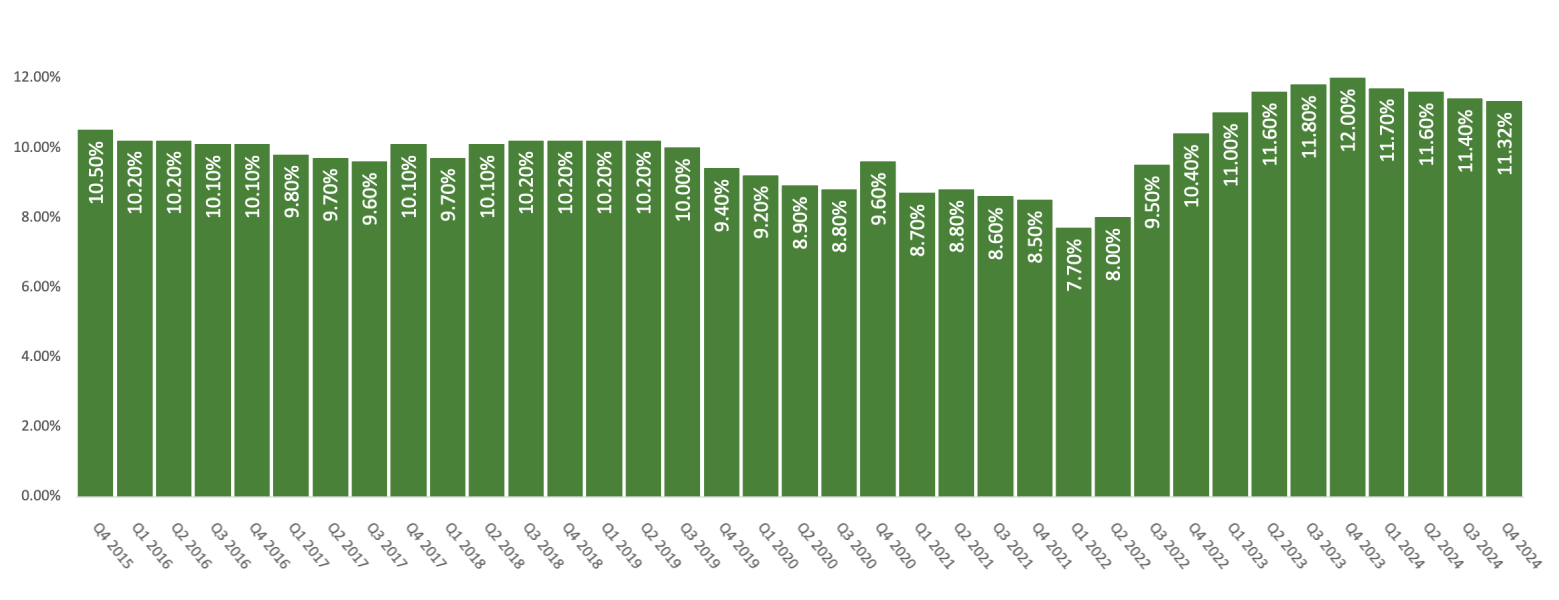

Average Return of 9.9% Since 2015

Why Adnate Capital?

At Adnate Capital, our mission is to democratize access to alternative investments through thoughtfully designed vehicles like our flagship fund, ACOF1. We are building a platform that offers investors access to high-quality opportunities supported by strong governance structures, transparent processes, and a long-term value creation mindset.